Inside the instance that particular can get to function through the holidays, you ought to be to make certain you don’t finish off getting to pay for more than the thing that was initially prone to the tax Service.

A lot of companies are really employing people as independent contractors rather than as employees. When one is engaged becoming an worker, he/ she’ll be needed to cover earnings, Medicare, and Social Security taxes, with one another known as FICA, that’s deducted from the person’s pay slip through payroll withholding.

Inside the instance that particular is engaged just like a contractor, he/she’ll lead to meeting all the taxes stated above. Even though those who fall in this particular category earn a fatter paycheck, they are needed to cover Medicare, Social Security, and incomes taxes. It is essential, therefore, to make certain that the very first is certain about his/her status of employment.

Most firms love engaging independent contractors as opposed to hiring their particular employees since in the tax position, it saves them lots of money. In this way, they do not have to undergo the manager problem of withholding taxes, while their companies also do not require creating any contributions to Medicare, Social Security, or any other federal unemployment taxes on wages to such contractors.

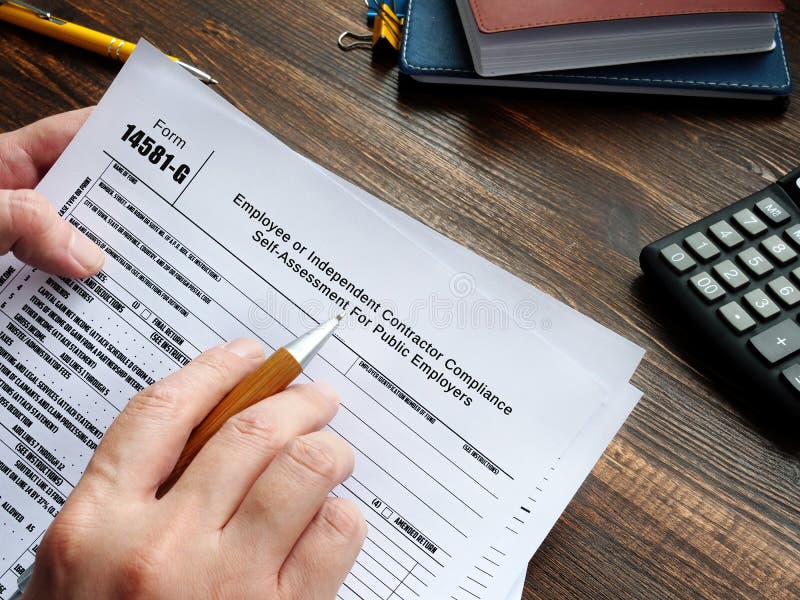

This really is really the main reason the tax Service as well as the Work Department have walked up their analysis into worker classifications. This role squarely rests round the two federal agencies. These agencies have became a member of into a comprehension, together with 11 states including Illinois, Connecticut, and Hawaii, making it simpler to speak about more knowledge about worker classification. The Federal Government features a new type in place made to let qualified employers determine worker misclassification matters simpler. Inside the program, each time a firm is made the decision to own wrongly classified workers as contractors, the business can certainly correct the issue by reclassifying the workers to acquire relief for a time out of your IRS audit. Similarly info mill open to employment investigations, result in the offending companies being accountable for additional taxes, as well as other penalties levied due to neglecting to fill W-2 forms. In addition, there is the elevated interest.

There are lots of means of working out whether the first is a professional or possibly an worker, nevertheless the primary strategy is through behavior control.

Once the firm has the legal right to direct or control that which you do within their job additionally to how you’re doing so, your engagement is definitely an worker. However, once the firm just dictates that which you do while not how one accomplishes the task, your engagement is an unbiased contractor.

0