If you’re thinking about growing a career in finance, accounting, or similar fields, you might be thinking about how to stand out in the market. While there are things you can do, one of them is growing your skills and expertise in fields like tax

This type of training can equip you with specialized skills that are always in demand, opening doors to new career possibilities and income potential.

To give you an idea, here are some reasons why tax preparer training can help you boost your career.

1. Gain Specialized Knowledge

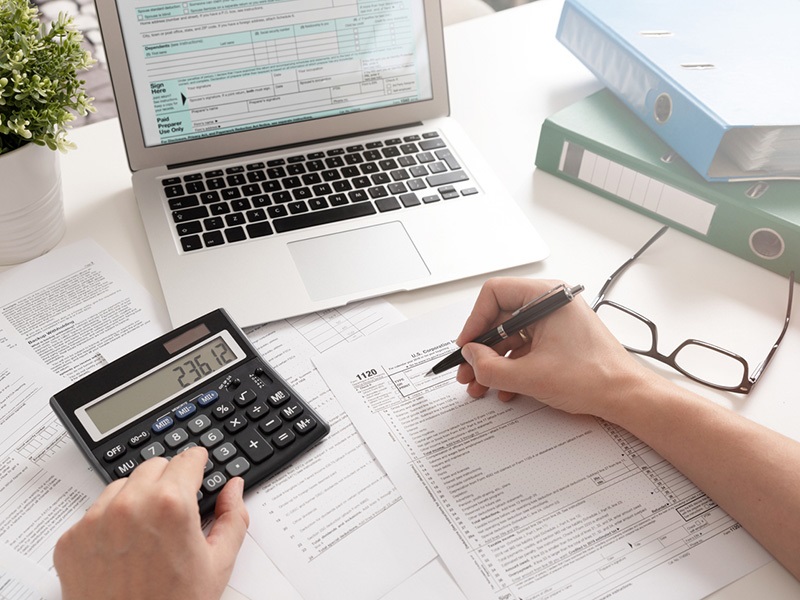

One of the biggest advantages of tax preparer training is that it gives you specialized knowledge in tax law and procedures.

Taxes are an essential part of life, and nearly everyone—whether individual or business—needs assistance in filing them correctly. Learning the intricacies of tax preparation can set you apart in the job market, whether you’re looking to work for a company or start your own tax preparation service.

The training covers everything from understanding different tax forms to learning how to file taxes electronically, which is now a standard in the industry. With this skill set, you’ll be able to offer a valuable service that’s always in demand, giving you a competitive edge in any financial career.

2. Open Doors to New Job Opportunities

Once you’ve completed your tax preparer training, you’ll find that it opens doors to a variety of job opportunities. Many businesses hire tax preparers during tax season, and even accounting firms often need seasonal help.

Additionally, having tax preparer certification on your resume can make you a more attractive candidate for full-time accounting roles of financial planning positions.

Whether you’re looking for seasonal work to boost your income or a permanent position that leverages your skills, tax preparer training can give you the qualifications you need to get your foot in the door.

You may also find that companies in other industries, like banking or human resources, value your tax expertise as an asset.

3. Increase Your Earning Potential

One of the most immediate benefits of completing tax preparer training is the potential for increased earnings. Tax preparers can earn competitive rates, especially during tax season when demand for their services is at its peak.

Whether you work for a company or freelance as a tax preparer, the specialized knowledge you gain can help you command higher pay.

You can even try freelancing as a tax preparer. You have the freedom to set your own rates and take on as many or as few clients as you want. For those who already have full-time jobs but are looking for a side hustle, tax preparation can be a flexible and lucrative way to supplement your income.

4. Build Client Relationships

Tax preparer training doesn’t just equip you with technical skills; it also prepares you to build strong relationships with clients. Taxes can be a confusing and stressful subject for many people, and they often look for someone they can trust to guide them through the process.

By completing your training and offering professional, reliable service, you can build long-lasting relationships with your clients. This can lead to repeat business year after year, giving you a consistent income stream. In some cases, clients may even refer you to friends and family, further expanding your client base.

0